When you’re new to a country, every decision can feel stressful. A mortgage isn’t just a mortgage. It’s a leap of faith. A pension isn’t just a savings plan. It’s your whole future on layaway.

And for many newcomers to Ontario, understanding the financial system takes time. Between navigating housing, income, and long-term planning, concepts like retirement or private lending can feel distant or just unfamiliar. That’s why education, delivered in the right language and context, plays such a crucial role.

That’s the challenge FSRA* brought to us. Not just to raise awareness but to educate, empower, and earn the trust of multicultural Ontarians.

Three cultural communities. One integrated campaign. Here’s how it unfolded.

*The Financial Services Regulatory Authority of Ontario (FSRA) is a regulatory agency that works on behalf of all stakeholders, including consumers, to ensure financial safety, fairness, and choice for everyone. More details can be found at www.fsrao.ca.

The Brief

For Private Mortgages, FSRA aimed to build brand awareness by educating individuals seeking mortgages from private lenders on essential information they need to know. The audience? New Canadians aged 25 to 40 who are financially vulnerable and not familiar with the terms and conditions of a non-traditional mortgage.

For Pensions, the goal was to educate people about the value of a pension and the benefits of saving as early as possible. The audience focus shifted younger: under 35, multicultural Ontarians (South Asian, Chinese and Filipino), including newcomers and first-generation immigrants.

Both campaigns ran in early 2025. And both shared one truth: financial literacy must be culturally and contextually relevant to actually work.

Trust Is Hard to Earn. Especially in 3 Languages.

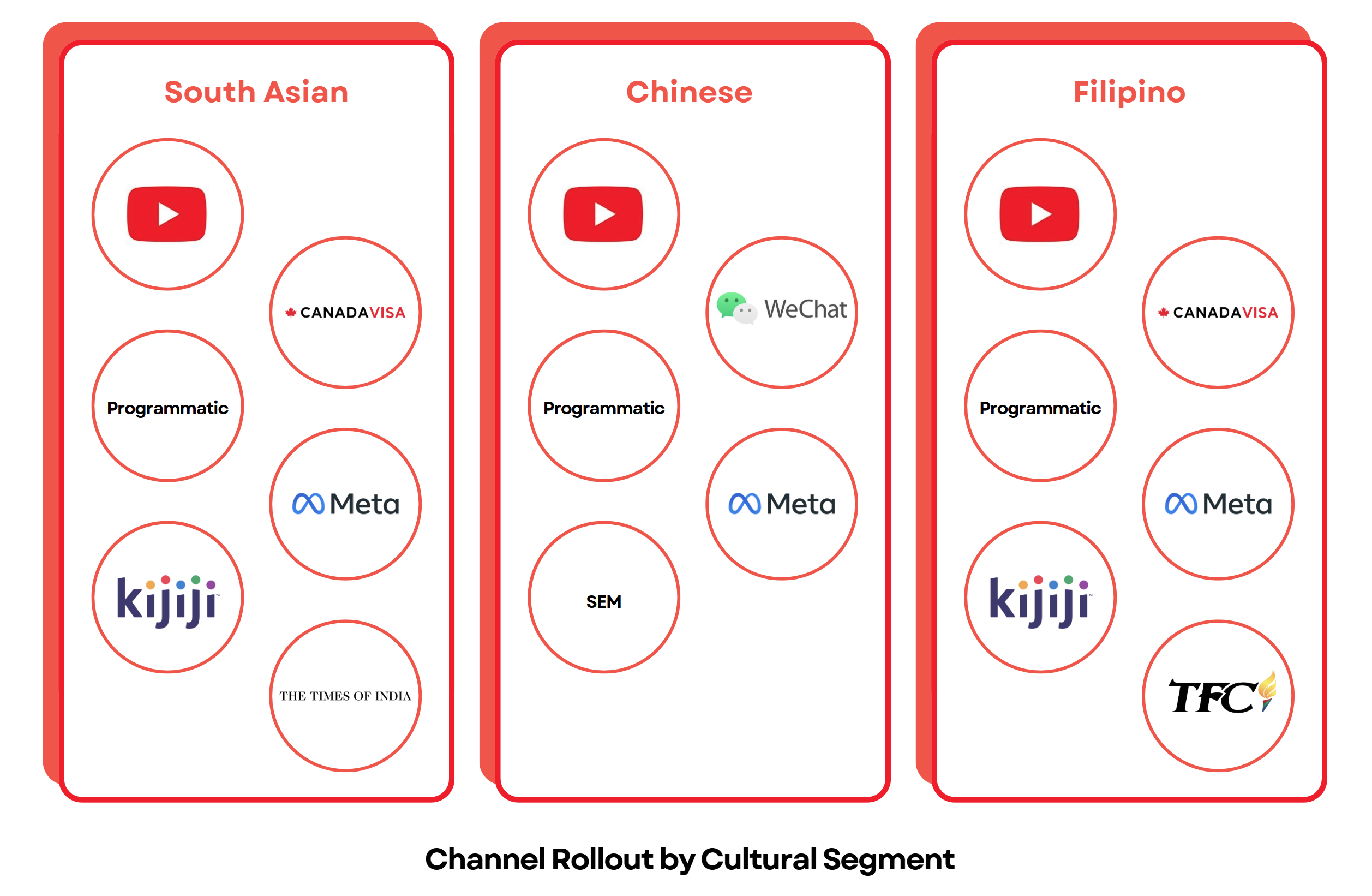

This campaign wasn’t about reach for reach’s sake. It was about being visible in the right spaces, with the right message, in the right language. We took a multicultural media approach, tailoring the plan to each ethnic group’s preferred platforms and behaviours.

Creative Approach: Localized. Not Just Translated.

This wasn’t just about language. It was about what each culture’s home looks like. So instead of templated ads, we crafted creative that reflected each group’s lived reality.

Every ad in this campaign was visually engineered to feel familiar. We studied real-life housing styles, room layouts, and furniture choices common within each cultural group and wove those into the creative.

Media Results That Spoke Volumes

Across both campaigns, the digital strategy delivered strong reach and engagement, outperforming industry benchmarks on multiple platforms. Messaging was tailored and distributed across YouTube, Meta, programmatic, SEM, and ethnic media channels—each selected for cultural relevance and performance potential.

Want the full breakdown? See our case study here.

PR: Because Trust Can’t Always Be Bought

While the media brought reach, PR brought credibility. We also secured earned coverage in outlets trusted by each community:

- Sing Tao Media, York BBS, 51.CA, and italkBB for Chinese readers

- South Asian Daily and Red FM for South Asian audiences

- Atin Ito for the Filipino community

These weren’t just press releases. They were thoughtfully localized stories—culturally adapted, language-accurate, and community-relevant. Each one was designed to empower readers with practical financial knowledge, delivered through the platforms they already trust.

The result: Over 2.39 million earned impressions across both campaigns. The message resonated so strongly that it even earned a feature on Omni TV, further validating the campaign’s relevance within multicultural communities.

What We Learned

- Speak to culture, not just language. The same words in different tongues don’t hit the same.

- Use channels people already trust. Ethnic media isn’t niche. It’s necessary.

- When you’re talking about money, clarity wins. Especially when trust is on the line.

Impact That Can’t Be Measured in Metrics

For FSRA, this campaign wasn’t just about KPIs or CPMs. It was about protecting people.

Because in a province as diverse as Ontario, financial literacy isn’t a nice-to-have but a must. And for many newcomers, a single ad or article might be the difference between being taken advantage of… or taking control.